Make the most of Retently - lessons from power users

Get inspired by companies transforming their Customer Experience.

Industries:

SaaS & Software

Financial Services

Ecommerce & Retail

USA

USA

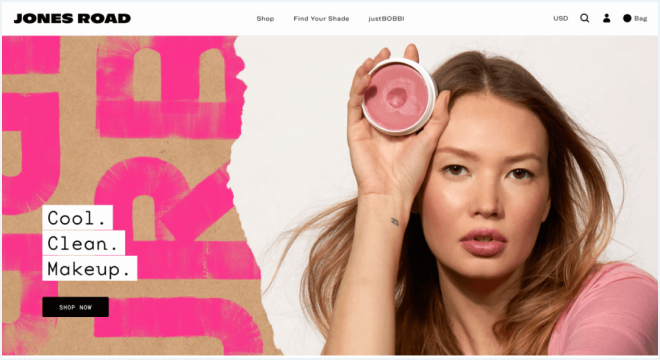

JRB prioritizes CX, building lasting relationships that drive customer LTV

USA

USA

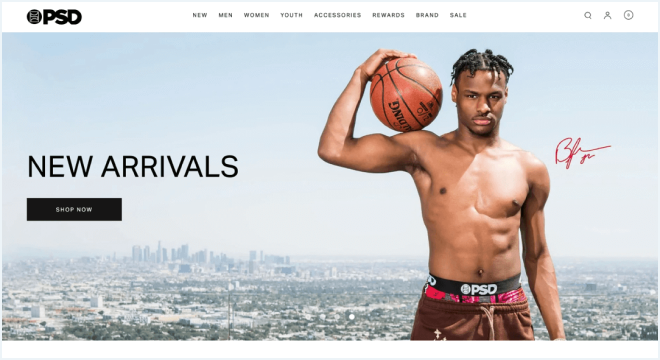

PSD tracks customer satisfaction at every stage of the customer journey

USA

USA

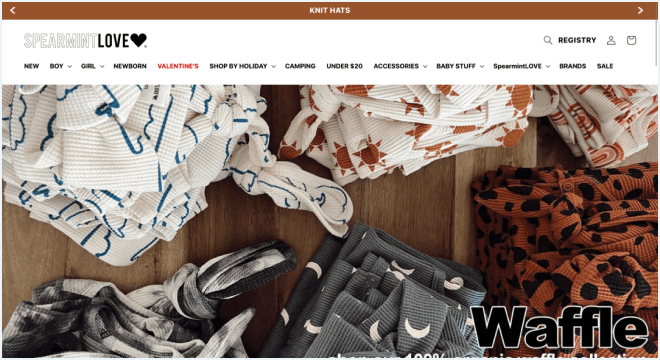

SpearmintLOVE measures customer satisfaction after each purchase

CANADA

CANADA

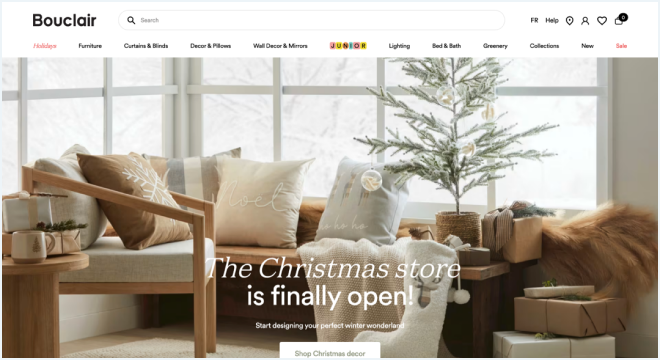

Bouclair surpassed a 65% survey response rate with Retently

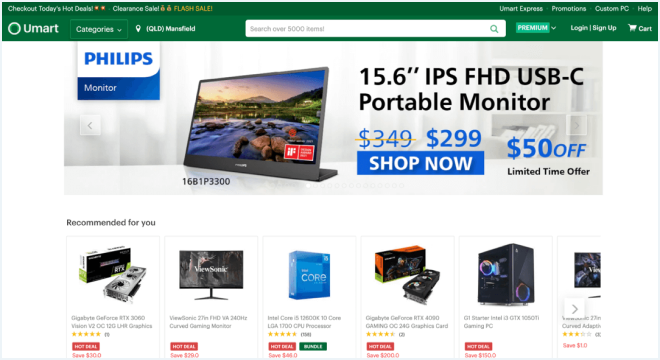

AUSTRALIA

AUSTRALIA

Umart has decreased twice the Customer Experience operations cost

Start your free 7-day trial

Get started with the world’s most trusted CX software, in days, not months.