This article provides a list of actionable tips to improve your email survey response rates. Although it was written with Net Promoter Score© in mind, it is applicable to any customer satisfaction – CSAT, CES, regular multiple choice surveys, etc.

Like every metric that depends on user-submitted data, NPS© gets more accurate as the audience size and survey response rate grows.

If you’re not getting enough responses from your Net Promoter Score campaign, there’s a real risk of your data not offering a full picture of your business’s health and ability to delight and retain customers.

Regular multi-question survey response rate is just over three percent — a slightly higher amount than the benchmark click-through rates for marketing emails. NPS surveys score much over the norm, with an average survey response rate of 30 to 40% for an effective campaign.

Luckily, it’s surprisingly easy to increase your NPS response rate and get more customer feedback (and more meaningful insights) from every delivered survey.

Below, we’ve shared 26 actionable tactics that you can easily implement with the right NPS software. They’re split into logical sections to cover various aspects of the NPS framework — from template personalization and survey deliverability to audience and schedule.

To jump to a specific section, use the quick links on the left.

Let’s get started!

1. Survey template personalization

Nowadays, clients want personalized service from the brands they buy from. Research shows that 79% of customers expect brands to get to know them on a deeper level and provide tailored offers and experiences. That means businesses need to incorporate personalization into every aspect of their client interaction — from email marketing and customer communications to the surveys they send.

1. Survey branding

One of the first things you’d want to start with is customizing your survey template to fit your company’s brand image.

You may not consider your surveys as a central part of your marketing messaging, but they are to your customers. These emails represent your brand just as much as any other interaction. Personalized surveys must look and sound like your company, so clients don’t get inconsistent experiences when they receive your NPS email in their inboxes.

Add your business logo to assert the legitimacy of your survey, then adjust the colors and styling that represent your brand. Make sure it follows the same concept as your product and advertisements since most people associate a company with their branding colors and style.

2. A/B test survey subject lines

The average email open rate is 25 percent. This means that if your NPS email is average, only a quarter of your target audience will open and read it, with an even smaller amount of respondents bothering to score and provide feedback. Increasing the conversion rate here can make a bigger difference in your bottom line than many other efforts.

The key to achieving a higher open rate — and as a result, a higher response rate — is to test a variety of email subject lines.

By experimenting with survey subject lines (“Do you have a spare 30 seconds? Please help us improve your experience” versus “Complete our survey!”) you’ll stand out from the hundreds of generic emails that most people receive on a daily basis.

Discovering a good subject line takes time. Aim for a subject line that’s personal, engaging and interesting without ever being ambiguous about the content of your email and you’ll strike the perfect balance of enthusiastic customers and detailed, actionable survey data.

Recommended reading: 15 Surprising Email Subject Line A/B Test Results You Need to Know

3. Address your customers by name

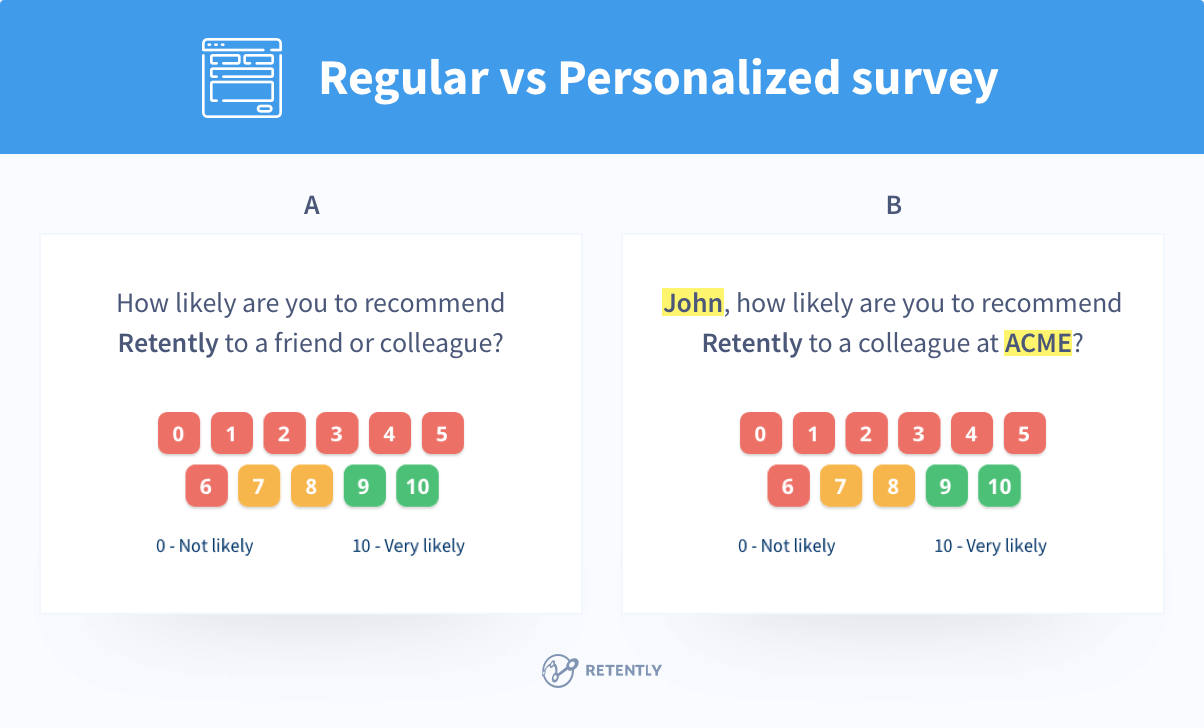

You can make your surveys more personal by using custom variables.

Survey template variables allow you to include information about the customer, such as their name, email address or any other custom properties you’ve stored about that client.

Add them to the survey email subject or body and address your customer by name, further mentioning his company.

Important, do not forget to also add fallbacks to variables, to handle the situation where that particular contact doesn’t have a value in the field you’ve chosen.

At Retently we did a study based on 100,000 surveys sent by our clients and concluded that the survey B in the image below gets a 30% higher open-rate, as compared to A.

4. Personalize Open-Ended Questions

Experiment with the standard NPS rating question and adjust the Open-ended question. Tailor it to particular customer groups – by subscription, lifecycle stage, industry, etc. – and customize the survey accordingly. The more targeted your survey templates are, the higher the response rate is.

So, just learn more about your customers and make sure your messages are witty enough to give them a second thought about participating in your surveys.

Recommended reading: 12 Great NPS Survey Question and Response Templates

5. Send the survey in your customers’ language

Regardless of the channel you opt for sending your surveys, make sure you are addressing your clients in their native language.

It’s important to change the language of the rating question as well as the follow-up question when you want to survey customers from different geographical areas.

Since your aim is to benefit from an increased response rate and to get the most out of the customer feedback, you must make sure your message is at least understood by the ones being approached. If sticking solely to the default options, ignoring the fact that some of your clients require a customized NPS survey in a specific language, you risk not receiving any feedback whatsoever.

Business is international, SaaS companies serve customers from all around the world. Thus, the touchpoints must be customized accordingly.

6. Make your mobile survey template look great

In a world where mobile dominates, responsive design has become the standard. Approximately 56% of all online traffic is mobile, making it important for your survey template to look great on mobile devices.

When you send an email survey or display it in your web application (in-app), you have no control over which devices your respondent will use. You have to make sure your NPS survey can be completed anytime and on any device.

Not sure if you’re doing it right? Run your survey template through Google’s Mobile-Friendly Test to see how responsive and mobile friendly your survey is.

7. No additional survey questions

Make your survey as simple as possible, as tempting it might be to add other survey questions!

At Retently, we do regularly receive requests from our customers asking to add more survey questions but have to refuse them.

If there’s one thing users hate, it’s an overly long survey. Luckily, Net Promoter Score makes this a non-issue by only asking respondents a single question before requesting their qualitative feedback.

Customers will naturally back out of surveys that appear to require a lot of time. Show them how easy it is to complete them and you’ll notice a measurable increase in your survey completion and response rates.

2. NPS email deliverability

Poor email reputation directly impacts deliverability, slowing down your NPS campaigns and sending them to spam folders. An excellent sender reputation helps get more surveys delivered to your customers’ inboxes without delay. In addition, many of the techniques for improving sender reputation will make NPS emails more engaging, increasing the open and click-through rates.

Best NPS tools will allow you to send the surveys from your own domain and offer even a dedicated email sending IP address. As you are the only one sending your emails over this IP, your sender reputation is shaped solely by your activity.

Recommended reading: The Ultimate Guide To Email Deliverability

8. Send your surveys from a real person

One of the biggest NPS mistakes you can make is sending your survey from a generic email.

If you’ve ever received an email from an address like no-reply@acme.com, you’d know why — the more generic an email address seems, the more likely you are to immediately trash it.

Instead of using a generic email address, configure your NPS service to send the survey from an email belonging to a real person. This way, customers will see that you’re reaching out with a personal survey instead of automatically sending a generic email to a large audience.

The sender’s details are important because many people will not open an email if they don’t recognize who it’s from.

Of course, if they are being sent from the Boss or the account executive responsible for that specific customer group the impact will be more visible. The user is more likely to open the email if they see a person’s name, ideally the head of the company (e.g. “John Doe, CEO @ Acme Inc”).

9. The Anita-effect

Take into consideration the Anita-effect which suggests that, within a male-dominated business, open rates are higher when the sender is a female.

Although the effect is not proven scientifically, getting a chance to test it on grounds of your own surveys is definitely worth giving it a try. Probably many would argue the theory, defining it as sexist or based on particular gender stereotypes and attitudes, while others will look at it as another opportunity or attempt to increase the survey response rate and bring in more business.

10. Send the survey from your company domain

Most Net Promoter services send the surveys from their own domains or mask the sender’s email, which is still not sufficient enough to provide a better email delivery rate.

Survey credibility is one of the first things respondents look at. By having your survey sent from your domain, respondents feel safer that their answers are received by the business they trust and that the collected information won’t be misused.

11. Setup SPF, DKIM, and DMARC records

DKIM (Domain Keys Identified Mail) and SPF (Sender Policy Framework) protocols allow email service providers (ESPs) like Google, Yahoo, and Microsoft, to filter incoming messages for spam or spoofed email addresses. The protocols verify the source of the incoming message, and if passed, the email will reach the intended recipients’ inboxes.

One quick method to improve your email delivery rates is to incorporate SPF and DKIM into your DNS settings. With this addition to your DNS entries, you’re telling recipients that you’ve authorized your NPS provider to send emails on your behalf. Without this change, your email has a higher chance of being marked as spam since it was addressed from your domain but sent from an IP address operated by your NPS service.

12. Send your surveys from a dedicated IP address

An IP address is a numerical label, a “digital label” assigned to a computer connected to the Internet.

A shared sender IP address refers to when multiple companies use the same IP to deliver their emails. They all share one IP address.

A dedicated IP allows you to digitally sign your emails and take full control of your sending reputation.

We recommend using a dedicated IP address for businesses doing high-volume sending. There are several advantages to opting for a dedicated IP as the below:

- You are completely in control of your IP’s reputation;

- Your emails will be signed with the domain or subdomain configured in your NPS service (SPF, DKIM and DMARC authentications), no other 3rd party domains being displayed;

- Certification services as Goodmail and SenderScore Certified, helping your survey emails to bypass the anti-spam filters, usually require a dedicated IP address;

- It facilitates being whitelisted with Gmail, Yahoo, and Hotmail.

- You should not send more than 1,000 surveys per day unless you’ve got a dedicated infrastructure and IP addresses supporting that.

13. Clean your email list

The quality of your respondents’ list is decisive for the success of your survey. With an audience that is genuinely engaged with your business, having a much higher response rate is undoubted assurance.

Maintain the quality of your clients’ list by regularly cleaning them with specialized services like Neverbounce, or their free alternatives.

Do your best to avoid surveying people not expecting it. Take a closer look at your bounce reports, import email suppression lists into your NPS software and regularly unsubscribe inactive customers.

Recommended reading: 7 Email List Hygiene Best Practices for a Fresh and Clean List

3. Survey audience tips

No client is equal, and each NPS email must craft the audience carefully, based on various factors, among which the customer lifecycle stage, industry, position, etc.

Do not send all your customers the same NPS email!

14. Segment customers, don’t survey too early

Timing is not just about asking the right questions; it’s also about segmenting users based on their current customer lifecycle stage and wisely triggering surveys to reach only the targeted segment.

For instance, if you ask newly signed up users how they find the overall product experience, they’ll mostly ignore the survey, and move on (because they just don’t know it yet!).

On the other hand, if you capture feedback from customers after they have had their first product interaction (post-activation), there are chances that a large percentage of users will happily engage and share their honest feedback.

In other words, you need to understand the positioning of your customer before you pop the survey, as there’s no point in gathering feedback of customers who have barely had a few interactions to form an opinion.

15. Prevent them during a call or quarterly business review

As a method of increasing the number of responding clients, try notifying your customers about the forthcoming survey. Customer success managers can do that during their regular quarterly business review with the client.

Studies concluded that pre-notification can increase survey response rates by 4 to 29%. Thus, notifications should be sent or otherwise communicated to clients who are supposed to receive a survey since research points to lowered refusal rates as well as higher general response.

16. Do not survey unhappy customers

There is nothing more frustrating than providing feedback and feeling that it’s not being listened to. In business, there are always situations when you can’t solve a customer’s issue immediately – either due to lack of resources, or a bug that has been postponed for various reasons, etc.

If you know that a client is unhappy with something you can’t fix in the near future, then don’t send them an NPS survey. Never ask for feedback if no follow up can be ensured. There is no point in sending a customer satisfaction survey with no action plan in mind. It will just bring frustration and waste of the customer’s time. Unsubscribe these clients temporarily from your next NPS campaign.

17. Respect customers’ privacy

Even before GDPR – the regulation impacting the way companies store and use the data from their customers – came into effect, businesses worldwide had to maintain practices that were respectful to the client’s data privacy.

People are more reluctant than ever to share personal information, so collect only the minimum data needed. Having a clear privacy disclaimer in your NPS email footer will make people more likely to answer honestly to your customer satisfaction mails. Thus, you will witness a positive effect on the average survey response rate.

Your privacy disclaimer, which must be part of your survey email, needs to include the following information:

- Collected personal data

- Use and disclosure of such personal data

- Contact information for particular clarifications or adjustments

- Ability to change or delete their personal information

4. Survey schedule tips

Here are some general rules that will help you do it right until you find a schedule that works best for you.

The first survey should be sent after your new customer has interacted with your business, approximately within the first 7 to 30 days – sufficient time span to have an opinion about your product.

Quarterly or even bi-annual recurring surveys are the ones to follow. These are the time intervals that seem to strike the best balance of regular feedback and convenience for customers, while still allowing to monitor if your customers’ satisfaction has changed during their lifecycle.

Meantime transactional surveys are the ones keeping a pulse on particular client interactions with your business. They are usually meant to assess the health and efficiency of specific processes (e.g. customer service, the purchasing process, online transactions, etc).

18. Send your surveys at the right time

It is important to keep in mind that the time you send out your survey is one among many factors that determine the response rate of your survey.

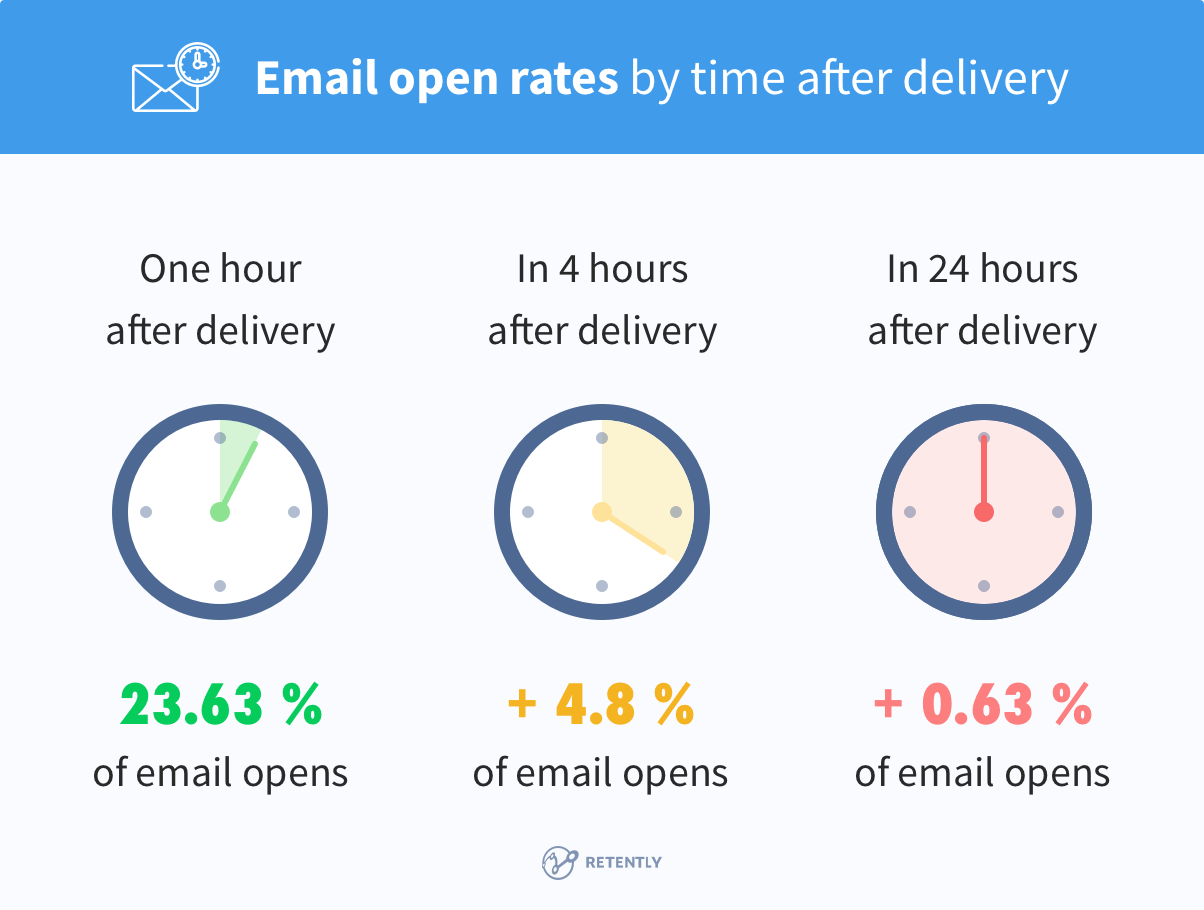

According to Smart Insights, 23.63% of all email opens occur within the first hour of delivery, with the rate dropping to as low as 4.8% by the fourth hour and 0.63% by the 24th hour. Your NPS email is competing with people’s personal or business emails, as well as with lots of spam and marketing newsletters.

Therefore it’s crucial to pick a right time to send your surveys at and make sure your customers will answer it. Most marketers believe that emails sent between 8-10 am are the most likely to be opened and read by customers, with the 8 pm to midnight time slot being another top performer.

An important feature you’ll want and need in an NPS tool is the ability to schedule your surveys so that they reach your customers at the most effective time possible, based on their timezone – called smart-send or survey timewarp.

19. Do not over-survey your audience

The opposite of surveying your customers once and then forgetting to engage them further is surveying them too often. By sending your survey every few weeks you’re more likely to alienate your customers than generate any meaningful feedback. For instance, Delta Air Lines and Starwood Hotels are asking their customers for feedback on every flight and every stay. Isn’t that too much?

Rather than asking customers for feedback at every touchpoint, set parameters on how often it makes sense for you to survey. For instance, at Retently we engage our clients once per quarter. The goal is to get an NPS response every six months. So if a client responds, he is skipped the next recurring campaign. If he doesn’t reply, we’ll go ahead and survey him next quarter.

But what is the right number of users to survey in a particular NPS campaign? This would much depend on what you are after: a statistically significant NPS to benchmark and report on or running a continuous voice of the customer program.

Measuring your NPS: The easiest way is to survey enough customers to get an NPS that is statistically significant. The number of respondents you need to sample will depend on how many clients you have.

Voice of the Customer: Customer-centric organizations may opt to survey all customers, collecting feedback and closing the loop. There are two sampling strategies: all customers at once or over a period of time.

All customers at once surveying is the classic campaign approach, sending a quarterly or bi-annual NPS email to all customers. This is fine when you have a relatively small amount of customers and need to get a quick reading on the score.

A more favored approach is surveying all customers over a period of time, in order to keep a constant pulse on customer satisfaction. If you used to send a quarterly survey to 3,000 customers at once, you would rather opt for surveying 1/3 of the subscribers, or 1,000 over a whole month. This way, all 3,000 would be surveyed each quarter.

In addition, you should be able to set up other scheduling rules such as:

- Daily survey limit: a cap on the number of surveys you can send per day.

- Survey throttle: ensures the same person is not over-surveyed if present in multiple campaigns (actual for companies running regular NPS campaigns, mixed with transactional surveys).

Whatever schedule you go for, one must respect the golden rule: do not over-survey your customers! Getting them annoyed will result in the quite opposite: your score will drop down, even if you have the best product on the market.

Recommended reading: Feedback Fatigue: Stop Over-Surveying Your Customers

20. Do not send more surveys than you can process

Survey your respondents no more than you can digest the customer feedback, respond to your customers, and develop an action plan. The effort becomes pointless if you do not have enough time to analyze the customer responses, understand your customer experience, and set forth next steps for improvement.

Inundated with data, you will find it impossible to read and respond to each customer in a timely manner. Make sure to have enough manpower to cope with the responses and that your team is able to efficiently act on that feedback.

Otherwise, automate the process and trigger different auto-reply messages for Promoters and Passives, and manually approach the Detractors. If your NPS software doesn’t support this function, you can integrate it using a service like Zapier.

5. Other tips

Not everything fits nicely into neat little boxes (ahem, categories). BUT that doesn’t mean those things aren’t important!

So, here are a few miscellaneous tips that you shouldn’t ignore.

21. Consider offering an incentive for respondents

As a general rule, incentives should be avoided for surveys and studies, since even a relatively small one, can influence a respondent’s opinion and result in inaccurate data.

Yet, if your NPS response rate is low and other tactics don’t work, adding a small incentive for users to complete your survey can be an easy way to generate more feedback. A variety of data show that incentives can increase survey response rates by 5 to 20 percent. These could be a discount, a giveaway or an account credit.

Basically, the participant is more likely to get involved when the reward of participation outweighs the cost. The average increase in response rates when offering incentives was 19.1 percent for monetary and 7.9 percent for non-monetary rewards. Incentives don’t have to be expensive to positively impact the amount of received feedback. Keep it small and you will boost your response rate without hurting the quality of your data.

Recommended reading: How to Turn a High NPS Into Reviews and Referrals

22. Use a survey channel that suits your audience

One of the biggest advantages of Net Promoter Score is its simplicity. Because NPS is a single question survey, it’s easy to incorporate it into any communication channel, from email to a web application.

A simple way to improve your response rate is to survey customers using a channel that matches their habits:

- If you communicate with your customers via email, you’ll generally get the best response rate by emailing them your NPS survey;

- If your product is a SaaS service, you’ll get a higher response rate by running an in-app NPS campaign;

- If your product is a mobile app, you’ll normally get the highest response rate by incorporating your survey into the app, using a mobile SDK.

The channel you use to communicate with your customers has a huge impact on your response rate. Choose the right one, or combine them for a better result, and you’ll maximize your survey’s visibility and generate the highest possible response rate from your target audience.

Recommended reading: Choose the Best Channel for your NPS Survey

23. Resend your NPS surveys

Some of your respondents on initially receiving the survey, will not complete it right away and may forget about it later. To maximize the survey output, you can remind this portion of your audience about the need to complete the survey. It is recommended to send no more than two or three reminders to avoid irritating your customers. Also, make sure not to send reminders to those who already completed the survey and leave an option to unsubscribe for those who are not interested in taking it.

Reminders are not designed to convince completing the survey but are meant to give those who didn’t have time during the initial launch a second nudge to participate. This being the case, your reminders’ effectiveness will depend almost fully on the survey schedule.

24. Process the auto-replies

We’ve all seen this kind of auto-replies when sending regular emails to our contacts. Have you ever wondered, how does your NPS service deal with them?

Most do nothing. A great survey service will let you know and provide a few options:

- Unsubscribe a contact who changed his job. This will improve the quality of the respondents’ list, therefore the survey response rate;

- Resend the survey in a few days or weeks, to still get it delivered, thus boosting the deliverability.

25. Show gratitude and take action

Act on the received feedback. Otherwise, there might be no next time and your surveys will get nothing but ignored.

Say thank you – it’s the cheapest and easiest tip. Show gratitude for customer time and for their feedback. Not only will it nurture a positive experience with your business, but it will also boost participation in future surveys. Here are a couple of nice outros:

- With your feedback, we’ll make your experience even better!

- Thanks for helping us out, you’re amazing!

- Thank you for taking the time to complete this survey.

Expressing gratitude to your customers for their time and efforts is a must since it shows the value of their feedback for you and encourages further fruitful interactions.

Recommended reading: Closing the Customer Feedback Loop: Turn Insights into Action

26. Choose the right NPS service and automate everything

Since NPS is a simple concept, it can be tempting to create and deliver your survey using a regular email client or send a basic NPS email with services like SurveyMonkey or Typeform. While doing so might save you a few dollars a month, it’s likely to cost you valuable time and resources that are better spent running your business.

A specialized service will provide a bunch of survey templates, useful reports, and automation capabilities. Also, advanced NPS products give the possibility to automatically send surveys based on specific customer touchpoints and even initiate conversations and close the feedback loop.

Recommended reading: Choose the Best NPS Software for Your Business

And that’s that!

Got any cool tips you would like us to add to the list? Leave us a comment and we’ll look at mentioning them in this article!

Greg Raileanu

Greg Raileanu

Christina Sol

Christina Sol