Given the dynamic hospitality landscape, where user experiences can make or break a business, Airbnb stands as a prime example of how customer feedback can shape an industry giant. Central to Airbnb’s customer-centric approach is the Net Promoter survey – a strategic tool for understanding guest satisfaction and loyalty.

Yet, Airbnb’s Net Promoter survey is not just another routine questionnaire; it serves as a beacon in an evolving market. In a time of endless choices, interpreting customer feedback is key to staying competitive – a lesson Airbnb excels in.

So, what exactly does the Airbnb Net Promoter survey entail? It’s more than just a set of questions; it’s a glimpse into the thoughts and emotions of Airbnb’s guests. This survey goes beyond the transactional aspects of a stay; it delves into the emotional connections between hosts, guests, and the unique places they briefly call home.

Join us as we analyze Airbnb’s surveys, explore their structure, and see how Airbnb redefines the travel and hospitality industry through insights. Learn from Airbnb’s journey as one of the world’s fastest-growing companies, registering a striking number of 393 million reservations in 2022.

These numbers speak volumes about their success in the startup landscape. Although Airbnb’s post-stay survey isn’t necessarily exclusively a typical Net Promoter Score (NPS) survey, it’s rich with lessons. Our goal is to break down Airbnb’s survey and extract insights, learning from the experiences of the iconic startup giant, Airbnb.

Net Promoter Score at a Glance

Before we dive into the details of the Airbnb Net Promoter survey, let’s grasp the essence of the Net Promoter Score. NPS is a metric designed to gauge customer satisfaction and loyalty. So, let’s break down the main components of the Airbnb NPS survey:

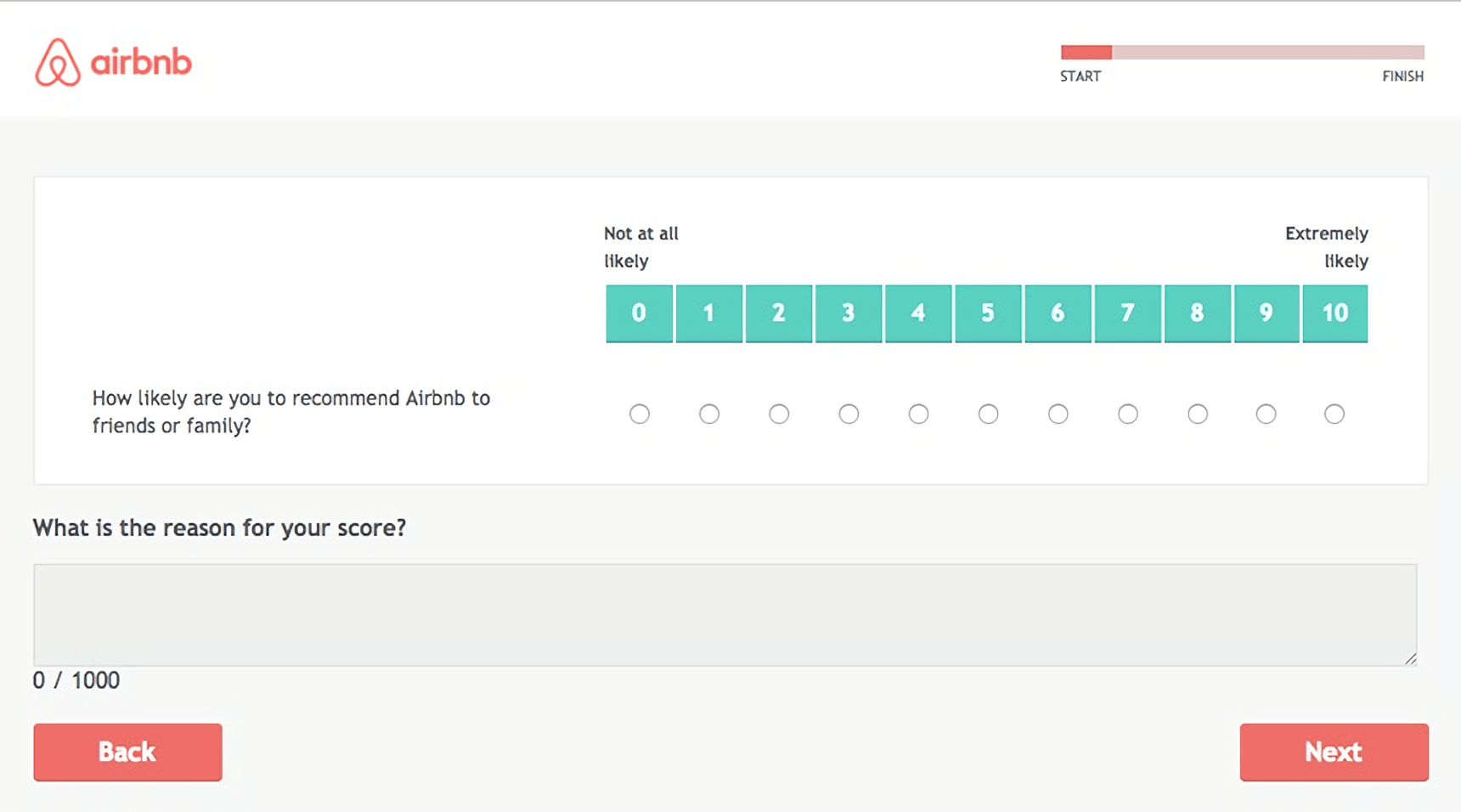

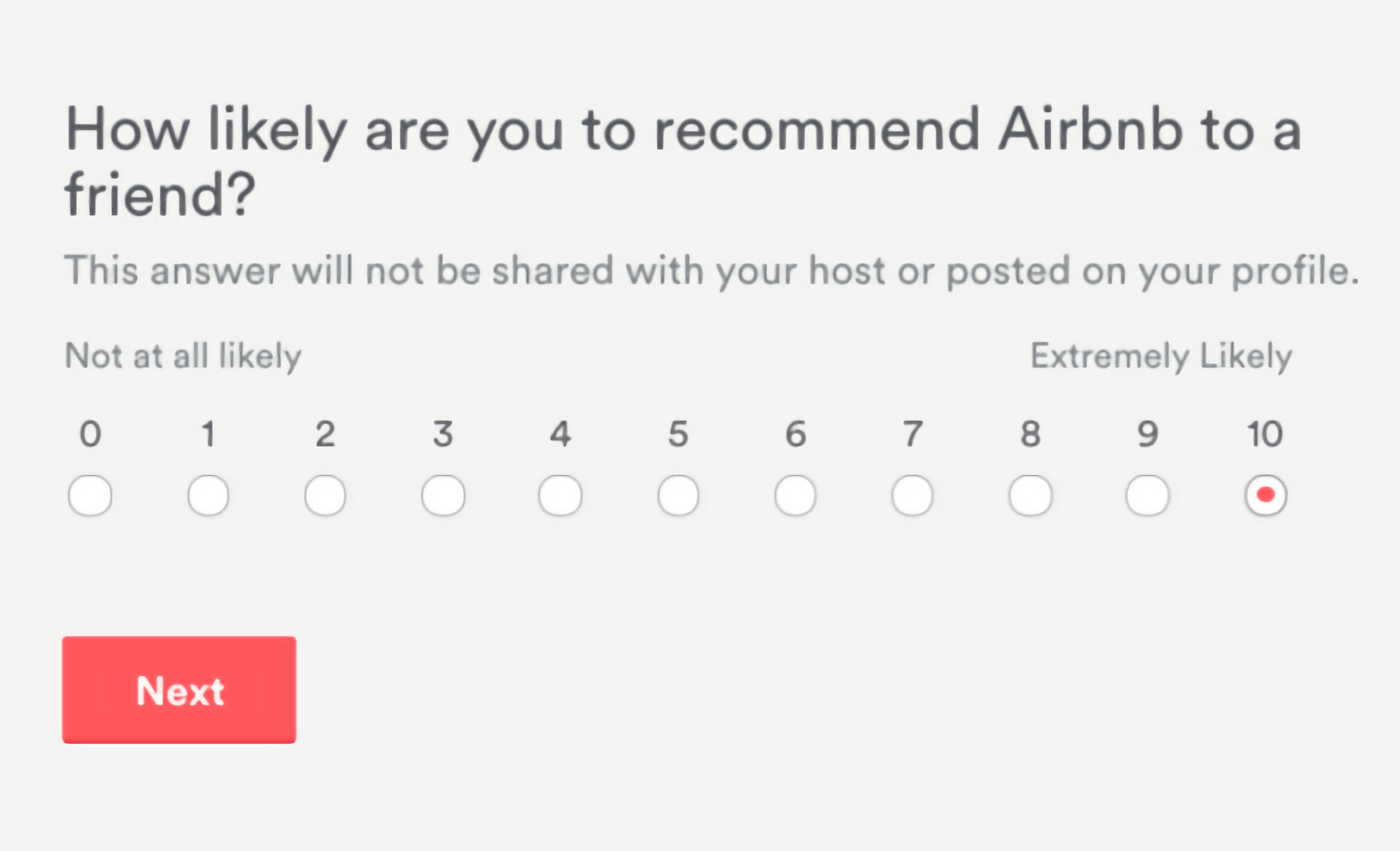

- The “How likely are you to recommend Airbnb to a friend or colleague?” question: This simple yet impactful question lies at the core of the survey. Respondents are asked to rate their likelihood of recommending Airbnb on a scale from 0 to 10. These ratings segment guests into Promoters (9-10), Passives (7-8), and Detractors (0-6), offering Airbnb valuable insights into overall guest sentiment.

- Follow-up questions or comments section: Beyond the NPS question, Airbnb encourages guests to share their thoughts, suggestions, and experiences. This open-ended section allows guests to express themselves freely, providing qualitative feedback that complements the numerical NPS score.

Collecting Customer Feedback

Timing is crucial in the Airbnb Net Promoter survey. Airbnb strategically sends out the survey shortly after a guest’s stay to capture fresh impressions while the experience is still vivid. The frequency of survey distribution varies but often aligns with significant touchpoints, ensuring Airbnb remains in tune with guest sentiments throughout their journey.

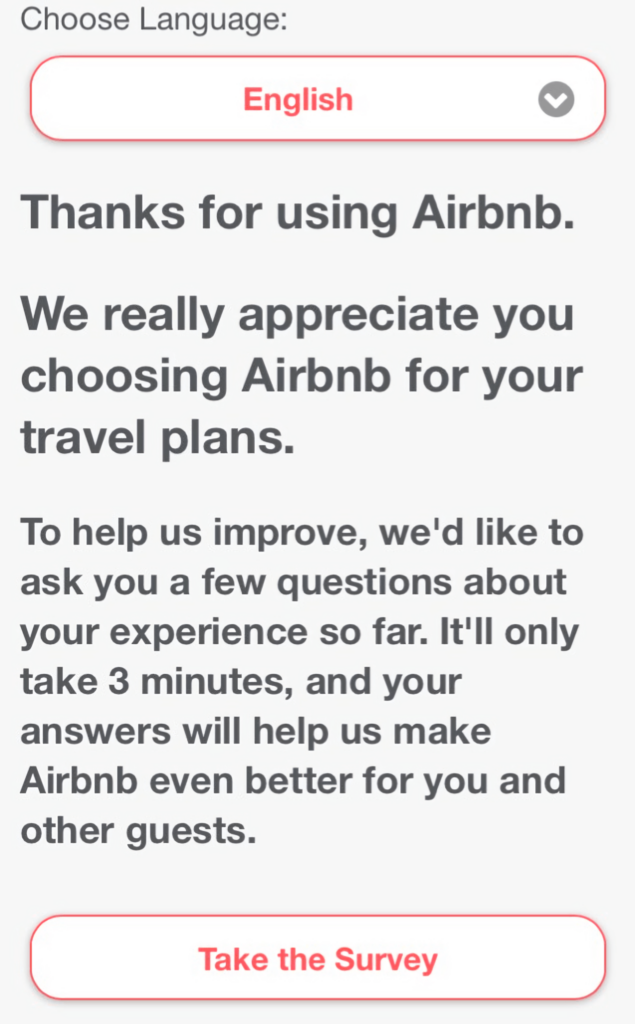

Airbnb takes a versatile approach when it comes to distributing the Net Promoter survey within its extensive network. The survey is typically delivered to guests through multiple channels, including email and in-app notifications. This diverse distribution strategy guarantees that Airbnb collects feedback from guests through their preferred means of communication.

1. Analyzing the Email Subject Line

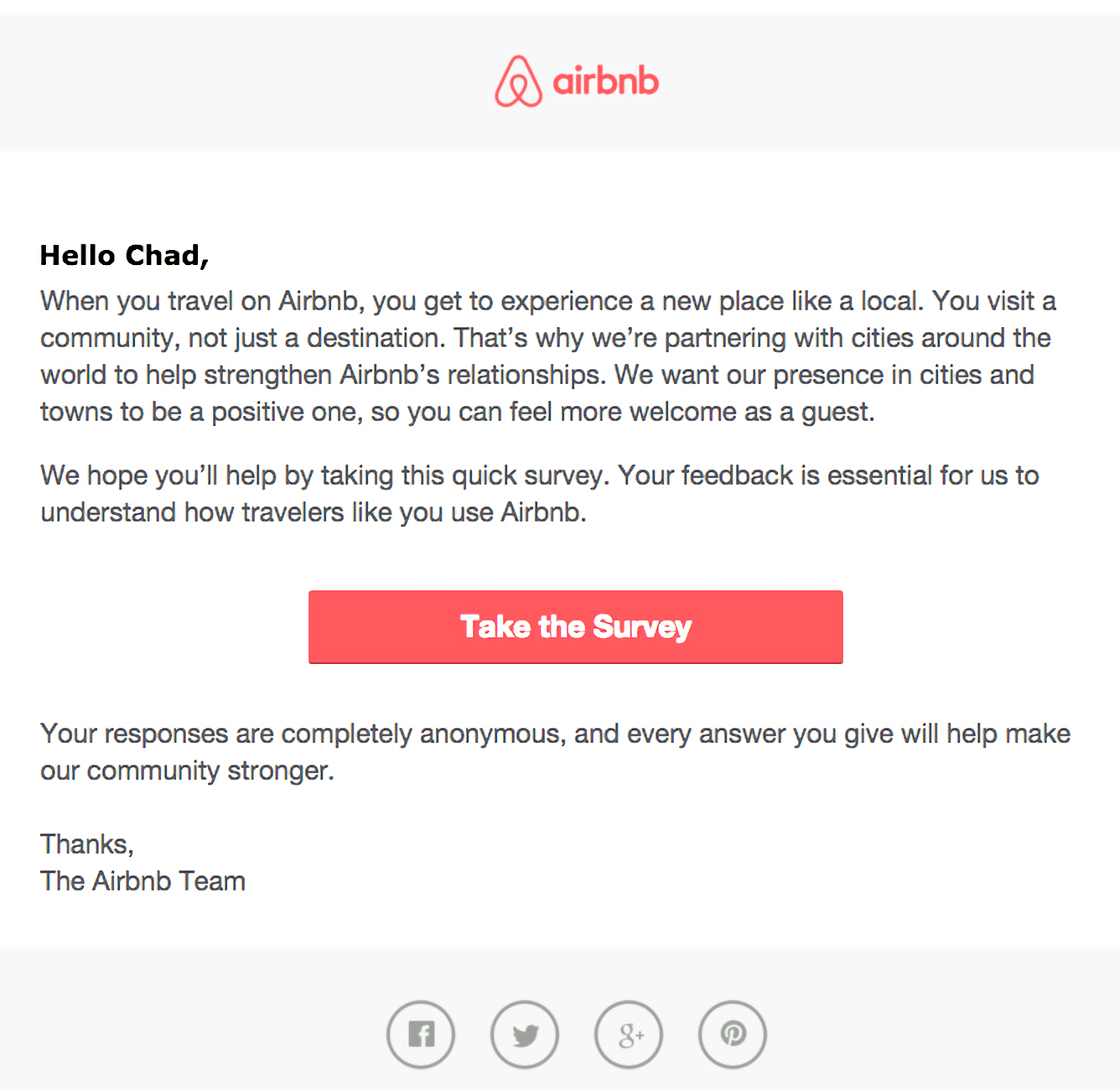

One of the initial touchpoints in the survey journey is the email subject line. Airbnb crafts these subject lines with care, aiming to grab guests’ attention and communicate the survey’s relevance. These subject lines may hint at the opportunity to influence Airbnb’s future or the chance to make their next stay even better.

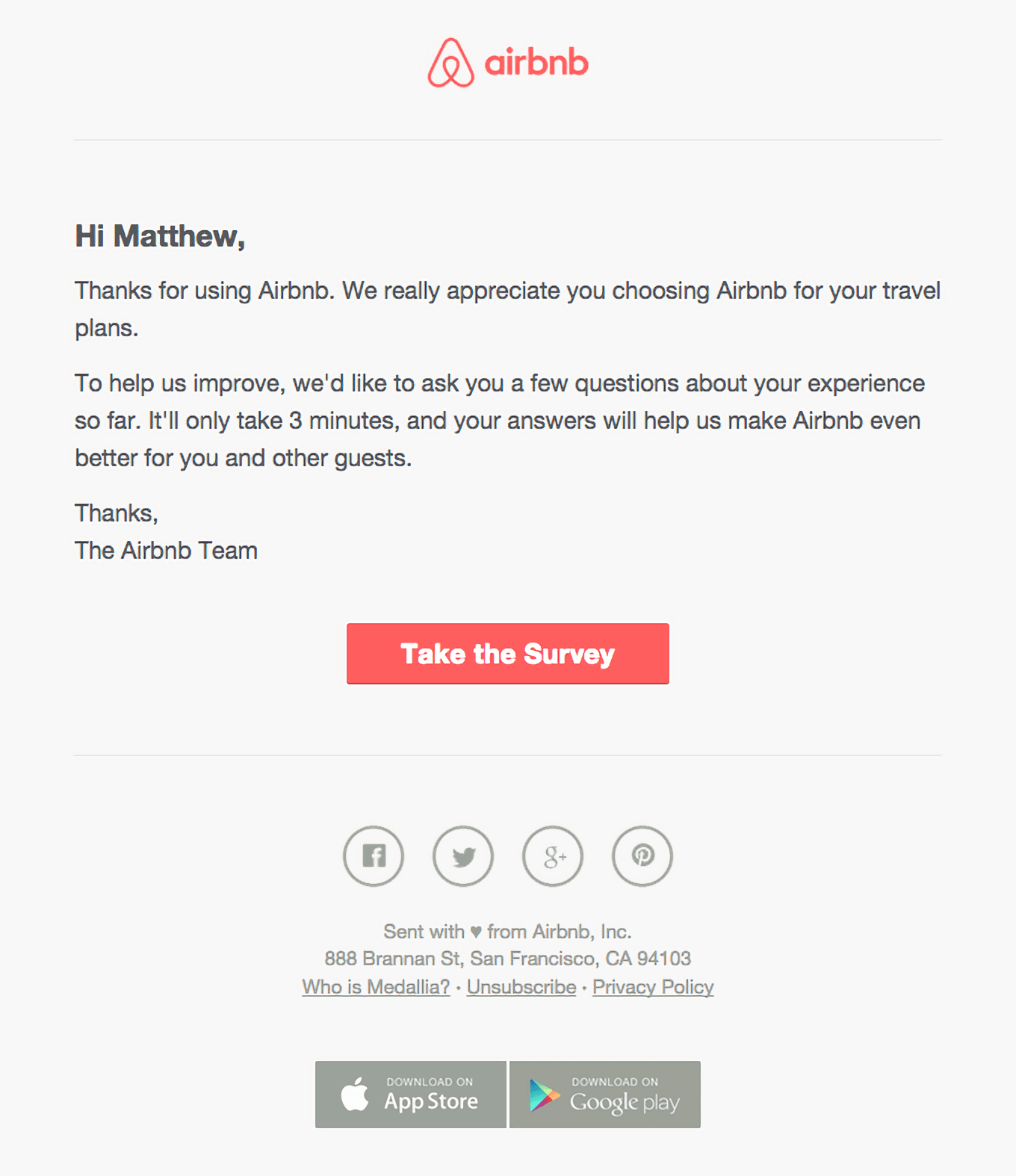

Much like other effective surveys, this one arrives conveniently in your email inbox. While we’ve previously discussed the drawbacks of in-app NPS surveys, it’s worth noting that this survey, could have been integrated into the app. However, the choice of email as the delivery method was a thoughtful one. It creates an additional brand interaction that wouldn’t have occurred otherwise.

Let’s talk about the email subject line. It’s quite decent, albeit a bit lengthy. The subject line reads: “Respond now to a 10-15 minute survey.” Although it leans towards the longer side (with most people checking emails on their smartphones, shorter subject lines of 3-4 words are ideal), the initial few words, “Respond now,” pique your curiosity. It conveys a sense of urgency, naturally prompting you to open the email and discover what requires your response.

When it comes to email engagement, crafting a brief and compelling subject line is half the battle. Short and enticing subject lines are the golden rule. For more actionable tips on engaging subject lines check our dedicated article.

2. Dissecting the Content

In the email’s content, Airbnb adopts a straightforward and friendly tone, making sure that guests grasp the survey’s intent and the significance of their input. The language used is warm and inclusive, assuring guests that their thoughts hold value. Airbnb frequently offers a brief intro to the Net Promoter Score, guiding guests on how to rate their experience, thus facilitating an effortless transition to the actual survey.

The content is quite effective, although in emails it tends to lean towards the lengthy side. Airbnb takes the time to provide context and justification for the survey, and approximate time required to take the survey, avoiding any undue influence. This approach might seem like common sense, but surprisingly, not many large companies follow suit. However, it makes a significant impact.

People want to understand the reasons behind requests and know that their voices are truly heard. If you fail to provide a rationale (and a thank-you closure), they might assume it’s merely a ploy for sending more marketing emails. But after reading Airbnb’s email or in-app message, you genuinely believe they have good intentions.

3. Looking into the Number of Questions

When it comes to the number of questions, Airbnb’s survey falls in the mid-to-high range with a total of 15 questions. As we’ve stressed previously, the rule of thumb is clear: fewer questions are better. Ideally, like the Net Promoter Score (NPS) approach, you should aim for just two questions to maintain high engagement and prioritize actionable written feedback.

Keep in mind that for every extra question you pose beyond those initial two, you can expect to lose roughly 30-50% of your respondents. With 15 questions, only a tiny fraction will complete the entire survey. This is why the average survey response rate hovers around 1-3%.

Now, if you’re Airbnb, serving tens of millions of customers annually, perhaps it’s acceptable to anticipate only a small fraction completing your survey. After all, that still translates to thousands of completed surveys per year, though it may not be a truly representative sample.

However, if your goal is to gather meaningful feedback from a smaller user base, remember this golden rule: shorter surveys yield exponentially better results. Additionally, they generate more written feedback, which, in truth, is the most critical component of the entire process. After all, the NPS score is relatively insignificant on its own.

4. Embracing Unbiased Feedback

In Airbnb’s quest for genuine insights, the importance of unbiased feedback cannot be overstated. Every guest’s perspective matters and Airbnb values the unfiltered opinions of its users. By encouraging guests to share their true feelings and experiences, Airbnb can identify areas for improvement and celebrate the elements that resonate most with its community.

Airbnb’s Survey Pitfalls

Even in the success story of Airbnb’s Net Promoter Survey implementation, there have been moments of learning. It’s important to highlight that even industry leaders can encounter hurdles along the way. So, what was Airbnb’s most significant survey pitfall, and what can we learn from it?

While Airbnb got off to a strong start with their email subject and content, they stumbled when it came to certain survey questions. Let’s analyze the issues:

- Static Questions: Airbnb included questions like, “If Airbnb had not been available, what would you have done?” and “How long would you have stayed if Airbnb had not been available, given your answer to the previous question?” These questions gather static information. Once you’ve collected responses from a substantial sample size, the answers are unlikely to change significantly in the future. When you repeatedly ask static questions and receive consistent answers, it’s a sign that these questions have outlived their usefulness in your survey.

- Question Placement: Another challenge was the placement of these questions early in the survey. It’s essential to remember that each question tends to reduce the audience size for the subsequent question by approximately 50%. So, not only are you asking questions where the answers are unlikely to evolve, but you’re also diminishing the audience available for more dynamic and relevant questions later in the survey.

In survey design, a fundamental guideline is to prioritize the most critical questions at the outset. Unfortunately, these two questions disregarded this principle not once, but twice. This serves as a valuable lesson for crafting effective surveys that yield meaningful insights.

What’s more, early in the day Airbnb understood that relying solely on a metric for gathering guest feedback is inefficient. At a certain point, Airbnb’s most valuable insights were from the reviews guests provided once their trip was over. These reviews, while optional, included text feedback and CSAT ratings ranging from 1 to 5, covering various aspects like Accuracy, Cleanliness, Check-in, Communication, Location and Value. In 2013, Airbnb introduced an additional question to their review form – NPS.

For example, while NPS is a valuable metric, it has limitations in providing detailed insights into guest experiences. The mistake here was assuming that a single metric could capture the complexity of guest satisfaction comprehensively.

They understood that feedback is not one-size-fits-all and that a more holistic approach was necessary. Here’s what other lessons Airbnb captured:

- Complementary Feedback Channels: Airbnb began to diversify its feedback collection methods. In addition to NPS, they started actively seeking feedback through reviews, direct messages, and surveys tailored to specific aspects of the guest experience.

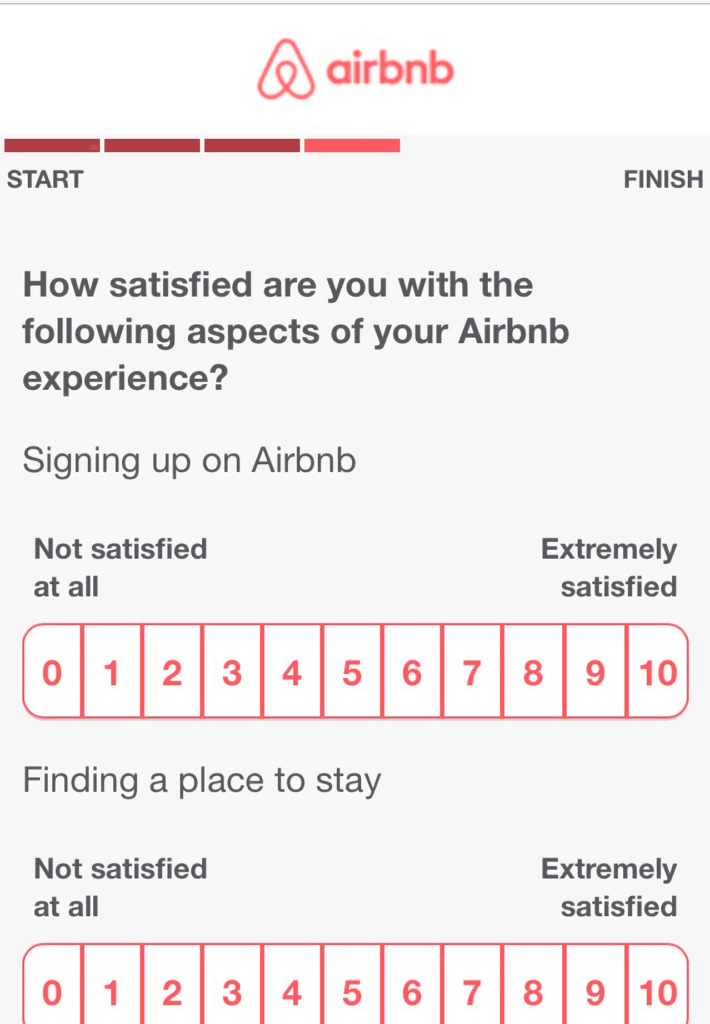

- Data Depth: Airbnb acknowledged the need for more detailed data. They introduced additional questions and open comment sections in their surveys to gain deeper insights into guest sentiments and pain points.

- Touchpoints in the Customer Journey: Airbnb drew proper attention to key touchpoints in the customer journey. After-service touchpoints are essential for collecting feedback and evaluating satisfaction, enabling necessary enhancements.

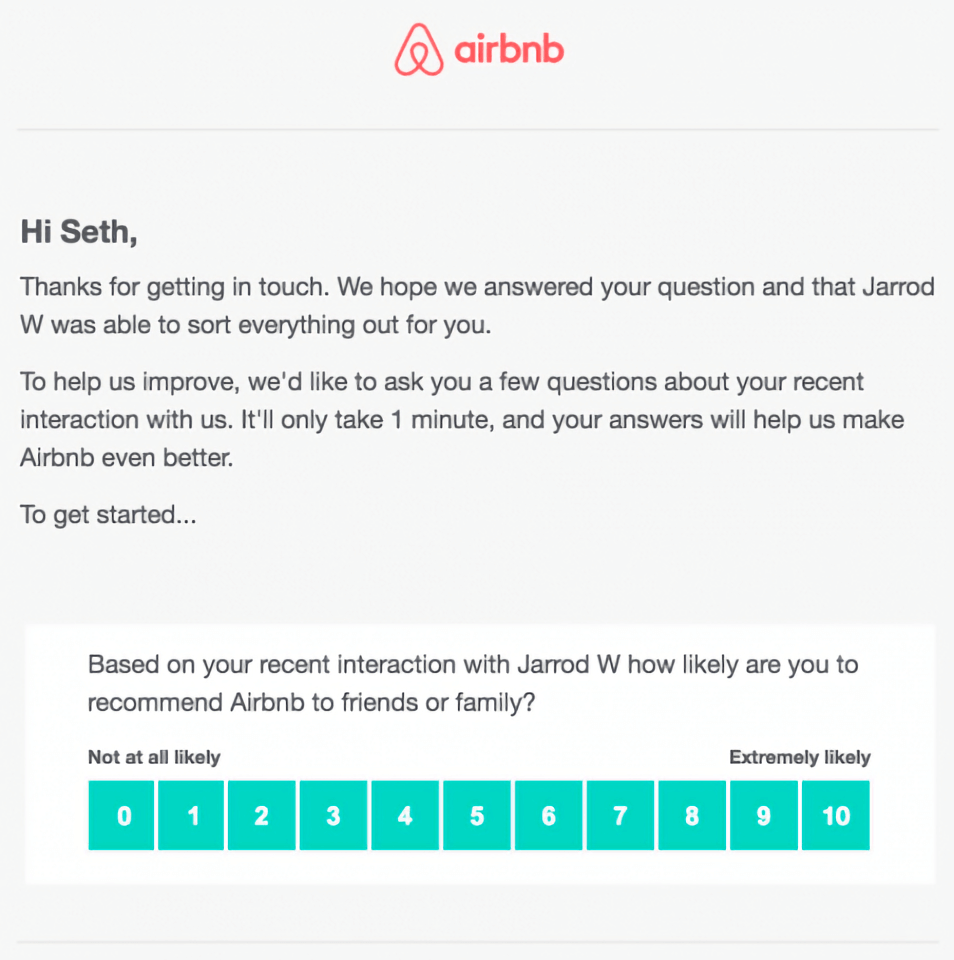

Airbnb post-service NPS survey

Airbnb post-service NPS survey

Net Promoter surveys sent during the experience provide chances for real-time engagement and relationship building.

The post-service touchpoints, once the experience concludes, are equally significant. Maintaining contact demonstrates dedication and can result in positive reviews, referrals, and repeat business, ensuring long-term success.

- Constant Improvement: They adopted advanced analytics tools, including specialized survey software, to extract more meaningful insights from feedback data.

This flexibility has allowed them to adapt to evolving customer needs and expectations successfully. Yet, their experience serves as a reminder that even the most successful companies can learn and grow from their missteps, ultimately improving the customer experience.

Wrap up

Airbnb’s use of the Net Promoter Score showcases how a well-implemented survey can drive growth and customer loyalty. The survey’s simplicity, timing, and diverse channels provide valuable insights for businesses in various sectors.

The NPS survey’s key question, supported by follow-ups and open comments, emphasizes the power of depth in feedback collection. Airbnb’s approach to timing and frequency highlights the importance of context in understanding customer sentiment. Their use of multiple channels underscores the need for a flexible approach to data collection.

Analyzing NPS results, interpreting scores, and identifying trends offer practical guidance for businesses leveraging customer feedback. Airbnb’s success in using surveys to improve services sets a model for building trust and loyalty.

In a journey marked by both successes and challenges, Airbnb’s example emphasizes the ongoing commitment to delivering exceptional customer experiences. As you seek ways to enhance your own customer interactions, consider the power of well-implemented surveys, embracing lessons learned, exploring diverse channels, and committing to excellence.

Ready to upgrade your customer experience? Sign up for a Retently free trial today and start collecting valuable insights to boost growth and increase loyalty.

Christina Sol

Christina Sol

Greg Raileanu

Greg Raileanu